Beyond Meat struggles continue in US, doubles down on EU expansion

Beyond Meat is struggling. In August, the US-headquartered plant-based meat pioneer announced its net revenue had fallen by almost a third, and its share price by 10%.

Fast forward three months, and earnings continue to falter: the company’s Q3 performance reveals negative sales growth six quarters in a row. Beyond Meat is in ‘survival mode’, according to analysts at TD Cowen.

Facing a challenging market in the US, the Beyond Burger maker has decided to ramp up its presence in Europe via a distribution deal with Nordic Food.

US alt meat category struggles, but ‘strong growth’ abroad

TD Cowen believes the company’s ‘deteriorating’ financial situation and ‘weak category consumption’ presents concern risk for investors. Last week, Beyond Meat further lowered its guidance and announced an 8% workforce reduction.

In Q3, Beyond Meat’s sales declined 9%, gross profit was at a $7.3m loss, and EBITDA a $57m loss.

Forty-five percent of Beyond Meat’s sales comes from the US retail meat alternatives category, which is declining. “The category struggles to retain new US customers despite various efforts,” noted analysts, citing attempts to lower pricing, increase promotions, and reduce price gaps between alternative and conventional protein.

The company’s net debt is now at $1bn compared to $883m at the beginning of the year.

Analysts are predicting Beyond Meat to remove some product lines from shelf, for example its plant-based jerky product, and as part of a business review potentially exit China. The company is expecting a product reorganisation to help reduce costs and free-up resources.

But ‘strong growth’ was recorded in international segments, driven by sales in both retail and foodservice. According to management, Beyond Meat is looking to focus resources on Europe, which it perceives as being a faster-growing market compared to the US.

Eyes on Europe: Beyond Meat enters Romania

Beyond Meat already has a strong presence in Europe, where it sells into Sweden, Austria, France, Germany, the Netherlands, and the UK. But the plant-based meat maker continues to look to new markets on this side of the pond.

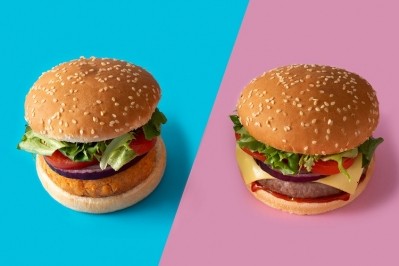

From November 2023, Beyond Meat products will be available in Romania thanks to a partnership with distributor Nordic Food. The company’s burger, sausage, mince and meatball alternative products will be sold in retail – both bricks-and-mortar and online – as well as foodservice, including in burger chain Submarine Burger.

Next year, Nordic Food hopes to rollout Beyond Meat’s Beyond Chicken Style range into the country, and expects the offerings will contribute to the ‘diversifying consumption behaviour’ in Romania.

From Beyond Meat’s perspective, the company said it is ‘delighted’ to expand its offerings into the European market. “Romania is one of the countries where the plant-based product category is in its early stages, but the demand for such products is growing,” said Ben van Looij, sales director Retail EMEA at Beyond Meat.